- Are you looking for a

Tax Consultancy?

Schedule your tax strategy session right now

- About Us

BizNess.pk delivers comprehensive tax consultancy and business registration services in Lahore, helping entrepreneurs and businesses navigate Pakistan's regulatory landscape with confidence. Our expert team specializes in company registration, tax compliance, and FBR-related services, ensuring your business operates smoothly and efficiently.

- Expertises

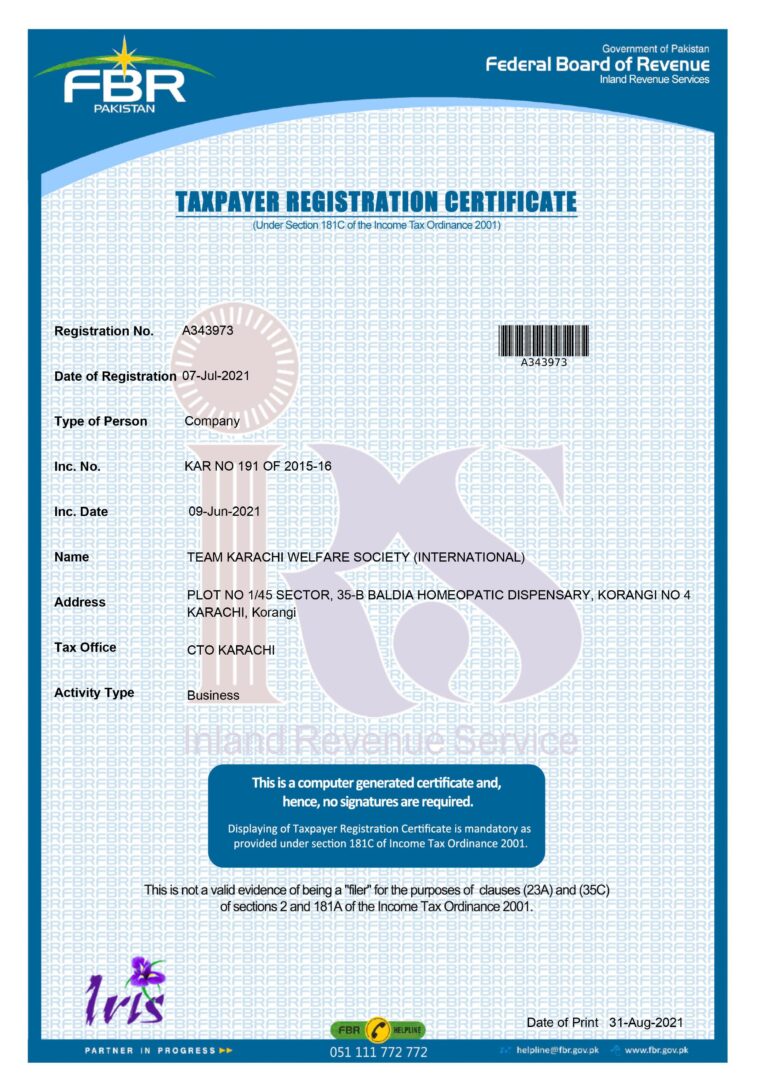

NTN Registration

NTN registration services to help you navigate the process smoothly and ensure compliance with the Federal Board of Revenue (FBR) regulations.

Individual Tax

Our dedicated team of tax consultants in Lahore is here to simplify the process and ensure that you comply with all tax regulations while maximizing your potential refunds.

Company Registration

Our consultants are well-versed in the latest regulations set by the Securities and Exchange Commission of Pakistan (SECP) and ensure compliance with all legal requirements.

Company Taxes

We develop customized tax strategies that align with your business goals, helping you minimize tax liabilities and maximize deductions.

Audit Assistance

Specialized FBR audit services to help businesses & individuals navigate the FBR audit process smoothly and effectively.

PRA Sales Tax

PRA sales tax services to help businesses comply with taxation laws while optimizing their tax liabilities.

- Our Strategy

Step

01

The first meeting

Understanding the Problem

The initial consultation typically spans 20-30 minutes, during which our experienced consultants engage in detailed discussions about your tax business requirements. We create a comfortable environment where you can openly discuss your business goals and concerns.

Step

02

The second meeting

Business Plan Consultant

The second consultation is a detailed 90-minute session where we transform our understanding of your business into actionable strategies. Our tax experts will present a customized plan that aligns with your business goals while optimizing your tax position.

Step

03

The final meeting

Problem Solved

In this 60-minute concluding session, we present the completed work and verify that all implemented solutions align with your business & tax objectives. Our team provides detailed documentation of all services rendered and ensures you fully understand the new systems in place.

- Frequently asked questions

We offer comprehensive business solutions including company registration, tax consultancy, NTN registration, and FBR compliance services. Our team handles everything from initial business setup to ongoing tax compliance and regulatory requirements. We specialize in providing end-to-end support for businesses in Lahore and across Pakistan.

For NTN registration, you’ll need your CNIC copy, proof of business address, bank account details, and business registration documents (if applicable). Requirements may vary based on whether you’re registering as an individual or a company. Our team will provide a comprehensive checklist during the initial consultation.

The company registration process typically takes 3-5 working days after submission of complete documentation. However, the total timeline can vary based on the company type, complexity, and SECP requirements. Our team works efficiently to minimize processing time while ensuring all regulatory requirements are met properly.

We maintain strict confidentiality protocols for all client information. Our secure data management systems and professional ethics ensure your business information remains protected. We sign formal confidentiality agreements and only share information with relevant authorities as required by law.

We offer continuous support including tax filing assistance, compliance monitoring, regulatory updates, and advisory services. Our team provides regular updates about changes in tax laws and regulations that might affect your business. We also offer annual tax planning and optimization services.

Our experienced team provides comprehensive support during FBR audits. We assist in preparing required documentation, responding to queries, and representing your interests before tax authorities. Our proactive approach helps minimize audit-related stress while ensuring compliance.

- Testimonials

- Our Team

- Are you looking for a

Business plan Consultant?

Schedule your company strategy right session now